Understanding Stock Market Efficiency & the Efficient Market Hypothesis 📈

Discover what stock market efficiency and the Efficient Market Hypothesis (EMH) mean, their significance, and how they impact investing strategies. A must-watch for investors and finance enthusiasts!

FIN-Ed

4.4K views • Apr 18, 2022

About this video

#fin-ed

What is Stock Market Efficiency | Efficient Market Hypothesis | EMH Explained | Fin-Ed

The earliest application of computers in economics in the 1950s was to analyze economic data series. Around that time, analyzing the behavior of the stock market over time was a natural candidate. Many believed that the peaks and troughs in economic performance must show up in stock price movements, suggesting that discernible price patterns are there and can be detected with certainty.

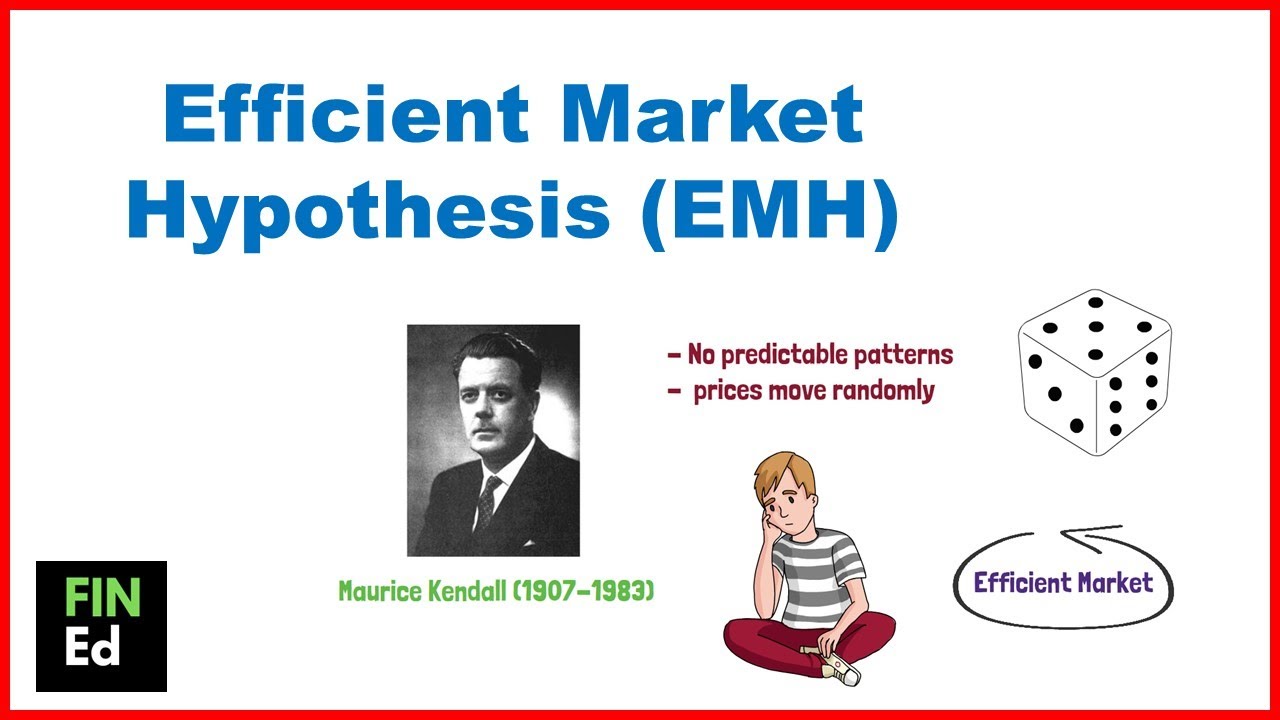

But to his surprise, Maurice Kendall in 953 examined this proposition and found no predictable patterns in stock prices. Prices seemed to evolve randomly. They were as likely to go up as they were to go down on any particular day, regardless of past performance.

The findings were disappointing and disturbing to many financial economists during that time. Many of them tried to reverse their interpretation of Kendall’s study. It soon became apparent that random price movement is a building block of a well-functioning or efficient market, not an irrational one.

In this video, I am going to discuss 4 aspects of stock market efficiency: Random walks model; Efficient market hypothesis; Implications of the EMH; Stock Market Anomalies; Are the market Efficient?

What is Stock Market Efficiency | Efficient Market Hypothesis | EMH Explained | Fin-Ed

The earliest application of computers in economics in the 1950s was to analyze economic data series. Around that time, analyzing the behavior of the stock market over time was a natural candidate. Many believed that the peaks and troughs in economic performance must show up in stock price movements, suggesting that discernible price patterns are there and can be detected with certainty.

But to his surprise, Maurice Kendall in 953 examined this proposition and found no predictable patterns in stock prices. Prices seemed to evolve randomly. They were as likely to go up as they were to go down on any particular day, regardless of past performance.

The findings were disappointing and disturbing to many financial economists during that time. Many of them tried to reverse their interpretation of Kendall’s study. It soon became apparent that random price movement is a building block of a well-functioning or efficient market, not an irrational one.

In this video, I am going to discuss 4 aspects of stock market efficiency: Random walks model; Efficient market hypothesis; Implications of the EMH; Stock Market Anomalies; Are the market Efficient?

Tags and Topics

Browse our collection to discover more content in these categories.

Video Information

Views

4.4K

Likes

51

Duration

12:25

Published

Apr 18, 2022

User Reviews

4.3

(4) Related Trending Topics

LIVE TRENDSRelated trending topics. Click any trend to explore more videos.

Trending Now