Master Decision Tree Strategy for Bidding: Should You Bid High or Low? 💡

Learn how to effectively solve a bidding problem using Decision Trees. This step-by-step guide covers bidding high or low, helping you make smarter decisions in competitive scenarios.

Joshua Emmanuel

16.6K views • Oct 4, 2022

About this video

This video shows how to solve a Bid High or Low problem using Decision Tree.

00:00 Question to solve

00:56 Decision Tree - High Bid

02:22 Low Bid

03:25 Complete Tree

Problem:

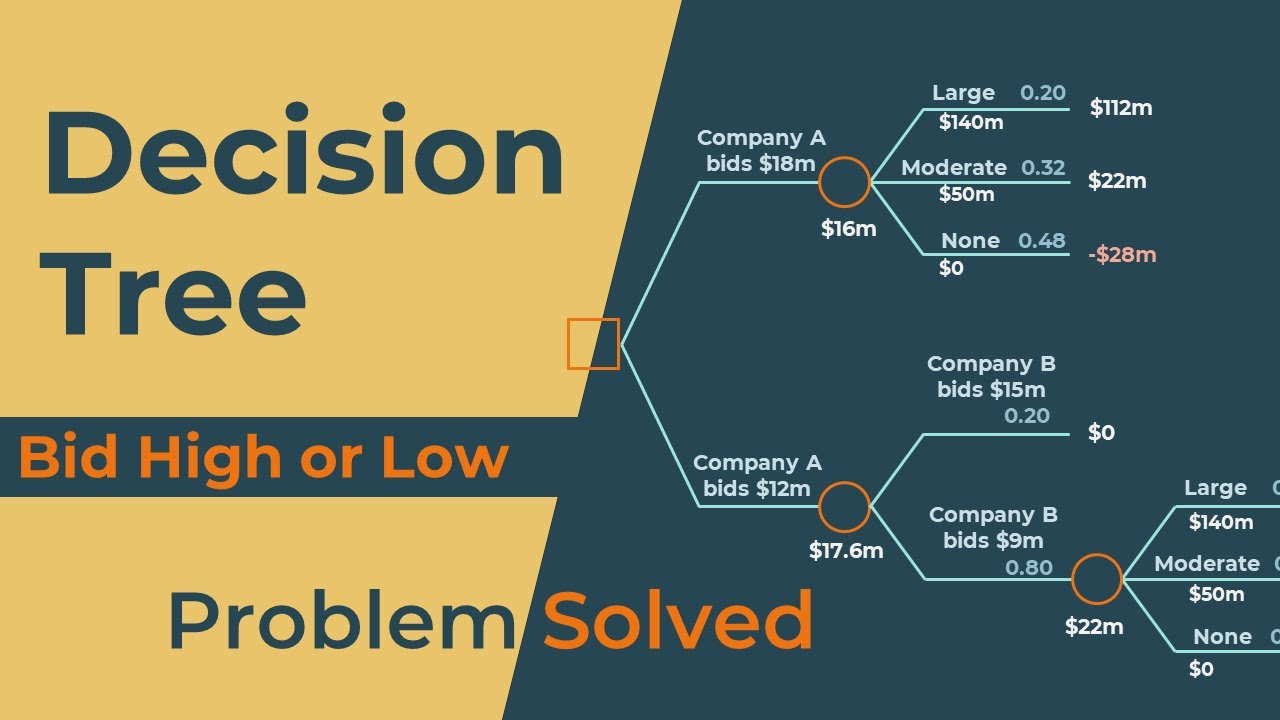

Company A is deciding whether to place a high bid of $18 million

or a low bid of $12 million for leasing rights to a mining site.

A major competitor (Company B) is also bidding for the same leasing rights.

There is a 0.2 probability that Company B will place a $15 million bid

and a 0.8 probability that they will place a $9 million bid.

Preliminary examination of the site indicates a 0.20 probability of large deposits with net returns of $140 million,

a 0.32 probability of moderate deposits with $50 million net returns,

and a 0.48 probability of no deposits.

The company that wins the bid will incur additional $10 million in extraction costs.

a) How should Company A bid?

b) What is the expected value of the decision?

References: Spreadsheet Modeling and Decision Analysis: A Practical Introduction to Business Analytics, Cliff T. Ragsdale, Cengage Learning, 2017

Sensitivity Analysis in Decision Analysis: https://youtu.be/ybz5AAlyrLk

00:00 Question to solve

00:56 Decision Tree - High Bid

02:22 Low Bid

03:25 Complete Tree

Problem:

Company A is deciding whether to place a high bid of $18 million

or a low bid of $12 million for leasing rights to a mining site.

A major competitor (Company B) is also bidding for the same leasing rights.

There is a 0.2 probability that Company B will place a $15 million bid

and a 0.8 probability that they will place a $9 million bid.

Preliminary examination of the site indicates a 0.20 probability of large deposits with net returns of $140 million,

a 0.32 probability of moderate deposits with $50 million net returns,

and a 0.48 probability of no deposits.

The company that wins the bid will incur additional $10 million in extraction costs.

a) How should Company A bid?

b) What is the expected value of the decision?

References: Spreadsheet Modeling and Decision Analysis: A Practical Introduction to Business Analytics, Cliff T. Ragsdale, Cengage Learning, 2017

Sensitivity Analysis in Decision Analysis: https://youtu.be/ybz5AAlyrLk

Tags and Topics

Browse our collection to discover more content in these categories.

Video Information

Views

16.6K

Likes

213

Duration

4:18

Published

Oct 4, 2022

User Reviews

4.5

(3) Related Trending Topics

LIVE TRENDSRelated trending topics. Click any trend to explore more videos.

Trending Now