Limitations of GSTR-1A Post GSTR-1 Filing | GSTR-1A Explained in Hindi

In this video, we explain what changes are not allowed in GSTR-1A after filing GSTR-1.

SS Digital India

9 views • Oct 24, 2025

About this video

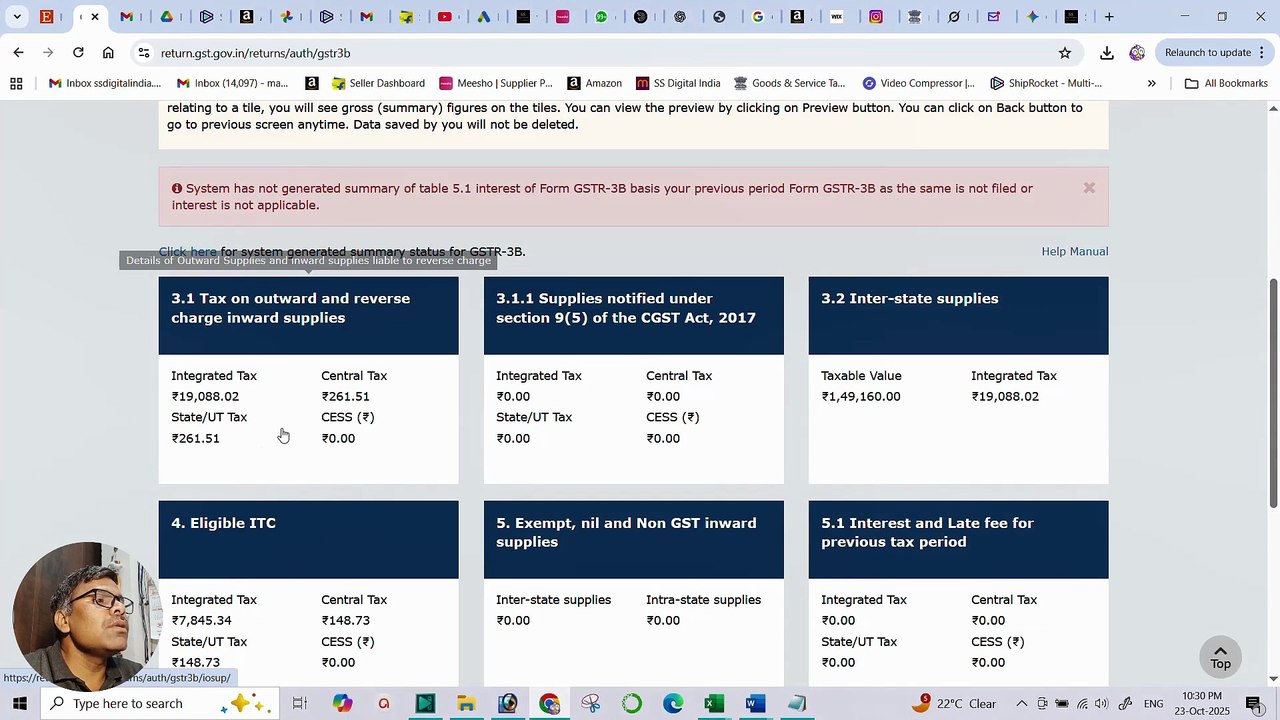

What Cannot Be Done in GSTR-1A After Filing GSTR-1? | GSTR-1A Explained in Hindi<br /><br />📝 Description:<br /><br />In this video, we explain what changes are not allowed in GSTR-1A after filing GSTR-1.<br />Know the difference between GSTR-1 and GSTR-1A, when amendments are possible, and what you must do if you need to reduce or correct sales after filing.<br /><br />👉 Topics covered:<br /><br />What is GSTR-1A?<br />When can you use GSTR-1A?<br />What cannot be changed after filing GSTR-1<br />B2B vs B2C correction rules<br />How to issue a credit note correctly<br />Practical example with GST portal steps<br /><br />📌 Watch till the end to avoid GST return filing mistakes and understand how to handle amendments safely.<br /><br />🔖 Hashtags:<br /><br />#gstr1a <br />#gstr1 <br />#gstreturn <br />#gstfiling <br />#gstindia <br />#gstamendment <br />#gstr1explained <br />#gstupdate <br />#gstonlinefiling <br />#gsteducation<br /><br />🧩 Keywords:<br /><br />GSTR-1A explained,<br />GSTR-1A after filing GSTR-1, <br />what cannot be done in GSTR-1A,<br />GSTR-1 amendment, <br />GSTR-1A changes, <br />GST return filing, <br />GST credit note, <br />B2B vs B2C amendment, <br />GSTR-1 correction, <br />GST portal guide, <br />GSTR-1A 2025 update, <br />GSTR-1A new rule, <br />GST mistake correction

Video Information

Views

9

Duration

17:16

Published

Oct 24, 2025

Related Trending Topics

LIVE TRENDSRelated trending topics. Click any trend to explore more videos.

Trending Now