GSTR-1 Tables 8A-D Explained: Nil, Exempt, & Non-GST Supplies 📊

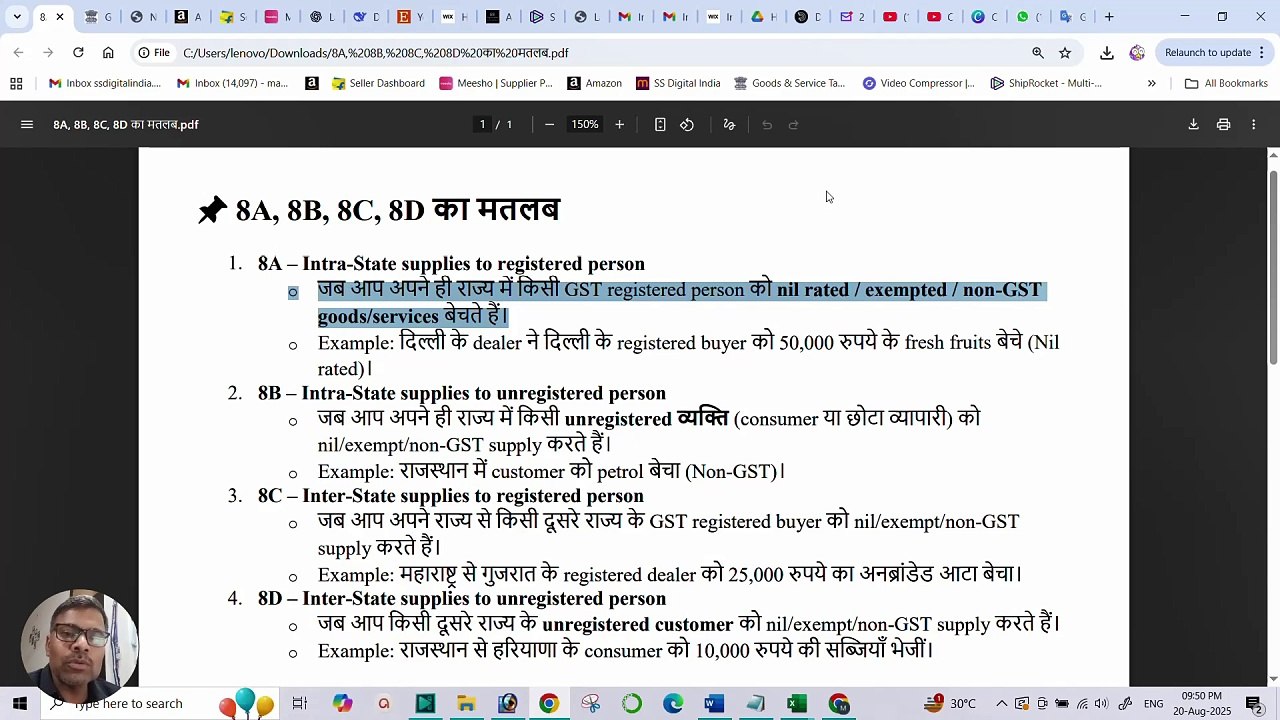

Discover a clear and simple explanation of GSTR-1 Tables 8A, 8B, 8C, and 8D, covering Nil Rated, Exempted, and Non-GST supplies to help you stay compliant and organized.

SS Digital India

74 views • Aug 20, 2025

About this video

All about 8A, 8B, 8C, 8D in GSTR-1 | Nil Rated, Exempted & Non-GST Supplies Explained<br /><br />📝 Description<br /><br />In this video, we explain GSTR-1 Table 8A, 8B, 8C, and 8D in detail. Learn what Nil Rated, Exempted, and Non-GST supplies mean, how to report them correctly in GSTR-1, and common mistakes to avoid.<br />Perfect for small businesses, accountants, and GST filers who want a clear understanding of reporting non-taxable supplies.<br /><br />📌 Topics Covered:<br />What are Nil Rated, Exempted, and Non-GST supplies?<br />Difference between Nil Rated, Exempted & Non-GST<br />How to report in GSTR-1 (8A, 8B, 8C, 8D)<br />Practical examples for better clarity<br />Mistakes to avoid while filing<br /><br />🔖 Hashtags<br /><br />#GSTR1 <br />#GSTFiling <br />#NilRated <br />#ExemptedSupplies <br />#NonGST <br />#GSTReturn <br />#TaxFiling <br />#GSTIndia<br /><br />🔑 Keywords<br />GSTR-1 8A 8B 8C 8D explained<br />Nil rated vs exempted vs non-GST<br />GSTR-1 non-taxable supplies<br />GST Nil rated supplies examples<br />Exempted supplies in GST<br />Non-GST supplies reporting<br />GSTR-1 table 8 filing guide<br />GST return filing tutorial India

Video Information

Views

74

Duration

11:28

Published

Aug 20, 2025

Related Trending Topics

LIVE TRENDSRelated trending topics. Click any trend to explore more videos.