Work from home in 2022 Australian Tax Return 💰😄 #shorts

I can't wait until after 30 June 2022 so I can lodge my 2022 tax return and get my long-awaited tax refund from another year like no other. Why am I expectin...

Money with Dan

536 views • Jun 4, 2022

About this video

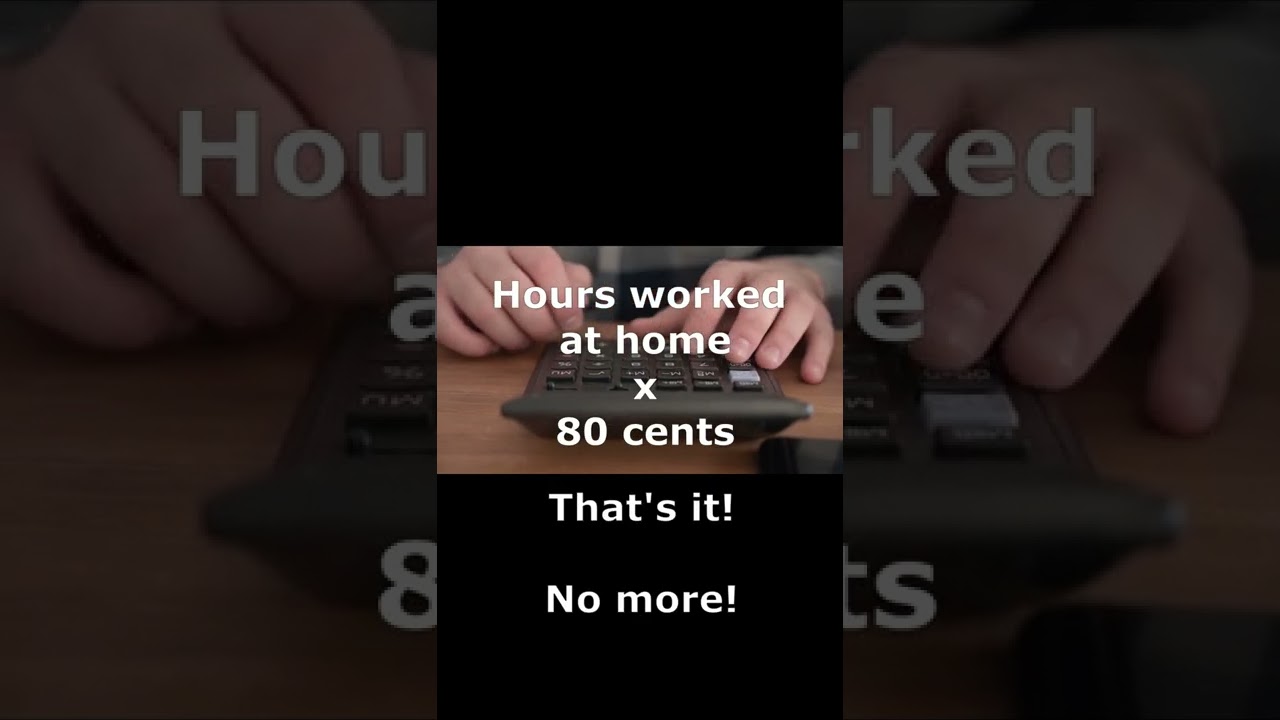

I can't wait until after 30 June 2022 so I can lodge my 2022 tax return and get my long-awaited tax refund from another year like no other. Why am I expecting a larger than usual refund this year?

In this video I am going to share how I'm going to calculate my working from home tax deduction in my 2022 Australian Tax Return and get a refund.

💰 My Excel Template that I use to track my taxes can be found on my online store here: https://www.etsy.com/au/shop/MoneyWithDan

OTHER VIDEOS

✔️ Higher WORK FROM HOME deduction in your 2022 Australian Tax Returnhttps://youtu.be/QDoESZHuhYI

✔️ Tax File Number (TFN) Declaration Form | Explained | AUSTRALIA only https://youtu.be/bRb5tcvY-JE

✔️ How to track expenses for TAXES automatically | less Excel data entry work for SMALL BUSINESS https://youtu.be/VwqSAiqMyQc

ATO LINKS

🔗 Work from Home Expenses instructions and COVID-19: https://www.ato.gov.au/general/covid-19/support-for-individuals-and-employees/employees-working-from-home/

🔗 Carry forward unused concessional contributions https://www.ato.gov.au/individuals/super/in-detail/growing-your-super/super-contributions---too-much-can-mean-extra-tax/?page=5

🔗 Claiming deductions for personal super contributions https://www.ato.gov.au/individuals/super/in-detail/growing-your-super/claiming-deductions-for-personal-super-contributions/

DISCLAIMER: it is important to note that the information in this video is for general information and entertainment purposes only and is not a replacement for professional advice. Money with Dan is not a financial advisor. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this video relates to your unique circumstances.

SUBSCRIBE for new videos!

#Taxrefund #taxtips #taxreturnaustralia

In this video I am going to share how I'm going to calculate my working from home tax deduction in my 2022 Australian Tax Return and get a refund.

💰 My Excel Template that I use to track my taxes can be found on my online store here: https://www.etsy.com/au/shop/MoneyWithDan

OTHER VIDEOS

✔️ Higher WORK FROM HOME deduction in your 2022 Australian Tax Returnhttps://youtu.be/QDoESZHuhYI

✔️ Tax File Number (TFN) Declaration Form | Explained | AUSTRALIA only https://youtu.be/bRb5tcvY-JE

✔️ How to track expenses for TAXES automatically | less Excel data entry work for SMALL BUSINESS https://youtu.be/VwqSAiqMyQc

ATO LINKS

🔗 Work from Home Expenses instructions and COVID-19: https://www.ato.gov.au/general/covid-19/support-for-individuals-and-employees/employees-working-from-home/

🔗 Carry forward unused concessional contributions https://www.ato.gov.au/individuals/super/in-detail/growing-your-super/super-contributions---too-much-can-mean-extra-tax/?page=5

🔗 Claiming deductions for personal super contributions https://www.ato.gov.au/individuals/super/in-detail/growing-your-super/claiming-deductions-for-personal-super-contributions/

DISCLAIMER: it is important to note that the information in this video is for general information and entertainment purposes only and is not a replacement for professional advice. Money with Dan is not a financial advisor. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this video relates to your unique circumstances.

SUBSCRIBE for new videos!

#Taxrefund #taxtips #taxreturnaustralia

Tags and Topics

Browse our collection to discover more content in these categories.

Video Information

Views

536

Likes

8

Duration

0:33

Published

Jun 4, 2022

Related Trending Topics

LIVE TRENDSRelated trending topics. Click any trend to explore more videos.

Trending Now