Understanding the Difference Between VAT and GST

This article explores the distinctions between VAT and GST, highlighting how the introduction of GST consolidates India's indirect taxation policy by merging various taxes into a single framework.

ROHIT kumar

50 views • Dec 13, 2016

About this video

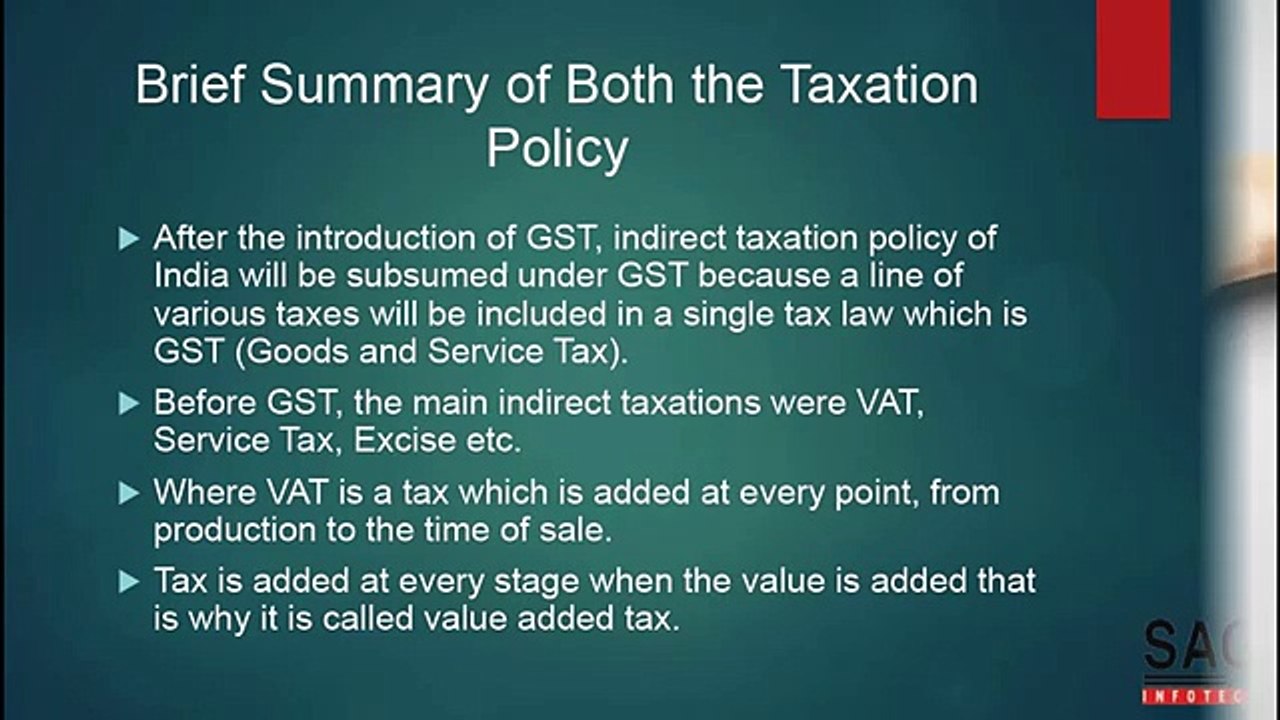

After the introduction of GST, indirect taxation policy of India will be subsumed under GST because a line of various taxes will be included in a single tax law which is GST (Goods and Service Tax). <br />Before GST, the main indirect taxations were VAT, Service Tax, Excise etc. <br />Where VAT is a tax which is added at every point, from production to the time of sale. <br />Tax is added at every stage when the value is added that is why it is called value added tax. <br /> <br />In this informative Video, you will find some details of GST VS VAT, Brief Summary of Both the Taxation Policy, Return to be Filed, Input Tax Credit etc. <br />For More Information Please Visit : http://blog.saginfotech.com/gst-vs-vat-differences

Video Information

Views

50

Duration

1:28

Published

Dec 13, 2016

Related Trending Topics

LIVE TRENDSRelated trending topics. Click any trend to explore more videos.