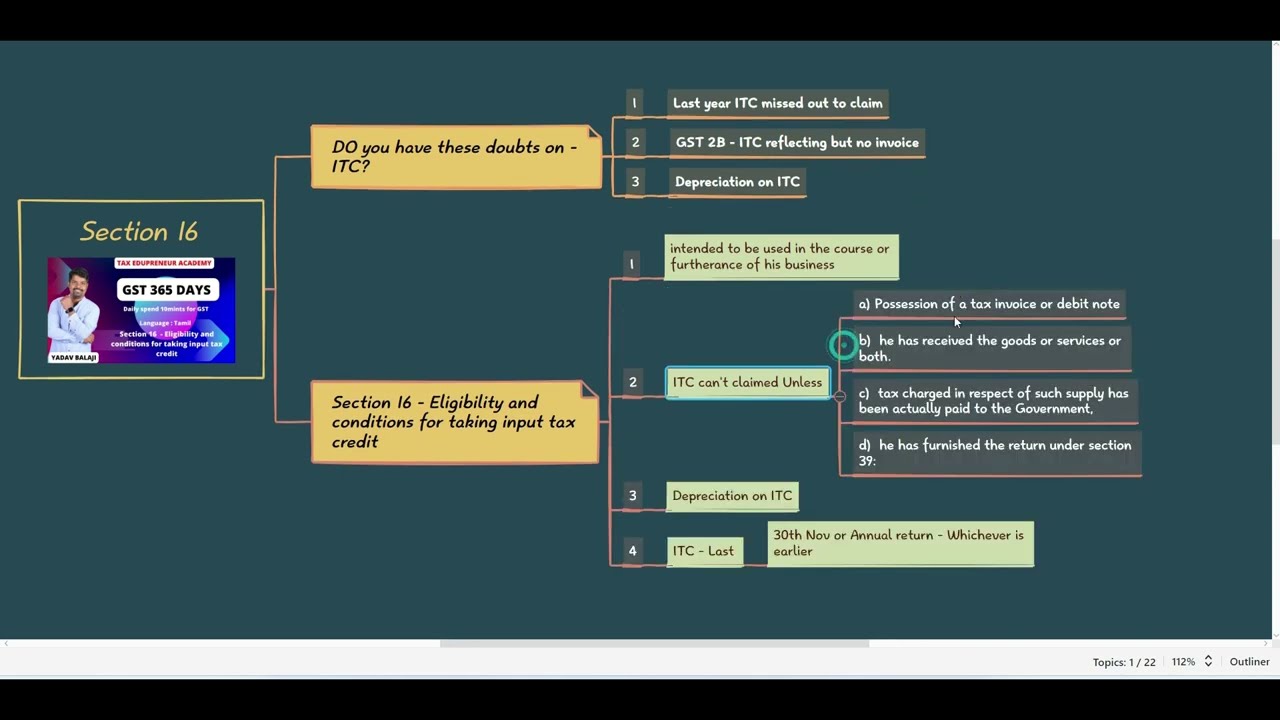

Section 16: ITC Eligibility & Conditions 📜

Learn about claiming Input Tax Credit (ITC), including eligibility, conditions, and handling missing invoices or missed ITC claims.

Yadav Balaji @ Tax Edupreneur_Tamil

1.3K views • Aug 3, 2023

About this video

Vanakam tamil makkale,

Do you have doubts on ITC claiming?

I don't have invoice copy can i claim ITC

Last year ITC missed out, can i claim now

On depreciation ITC claimable

When is the last date to claim ITC

What are the condition to claim ITC

What is section 16 of cgst act 2017

All the question there is Answer with Section 16, kindly watch it.

To get more update on Income tax , GST, TDS, PF and ESI follow us and Join our FREE telegram group https://t.me/Taxeduprenur

If you are interested to learn about Taxation and Labour Law WhatsApp us at 74 18 83 84 84

#gst #gstupdates #gstsection #gstrules #gstregistration #gstreturnfiling #gst365dayschallenge #yadavbalaji #taxedupreneuracademy #incometax #incometaxreturn #epf #esic

Do you have doubts on ITC claiming?

I don't have invoice copy can i claim ITC

Last year ITC missed out, can i claim now

On depreciation ITC claimable

When is the last date to claim ITC

What are the condition to claim ITC

What is section 16 of cgst act 2017

All the question there is Answer with Section 16, kindly watch it.

To get more update on Income tax , GST, TDS, PF and ESI follow us and Join our FREE telegram group https://t.me/Taxeduprenur

If you are interested to learn about Taxation and Labour Law WhatsApp us at 74 18 83 84 84

#gst #gstupdates #gstsection #gstrules #gstregistration #gstreturnfiling #gst365dayschallenge #yadavbalaji #taxedupreneuracademy #incometax #incometaxreturn #epf #esic

Tags and Topics

Browse our collection to discover more content in these categories.

Video Information

Views

1.3K

Likes

34

Duration

6:18

Published

Aug 3, 2023

User Reviews

4.5

(1) Related Trending Topics

LIVE TRENDSRelated trending topics. Click any trend to explore more videos.