Master the LBO Model: How Leveraged Buyouts Work 🏦

Discover the fundamentals of leveraged buyouts (LBOs) and learn how to build an effective LBO model. Perfect for aspiring finance professionals looking to deepen their understanding of M&A strategies and financial modeling.

Mergers & Inquisitions / BIWS

40 views • Jun 2, 2016

About this video

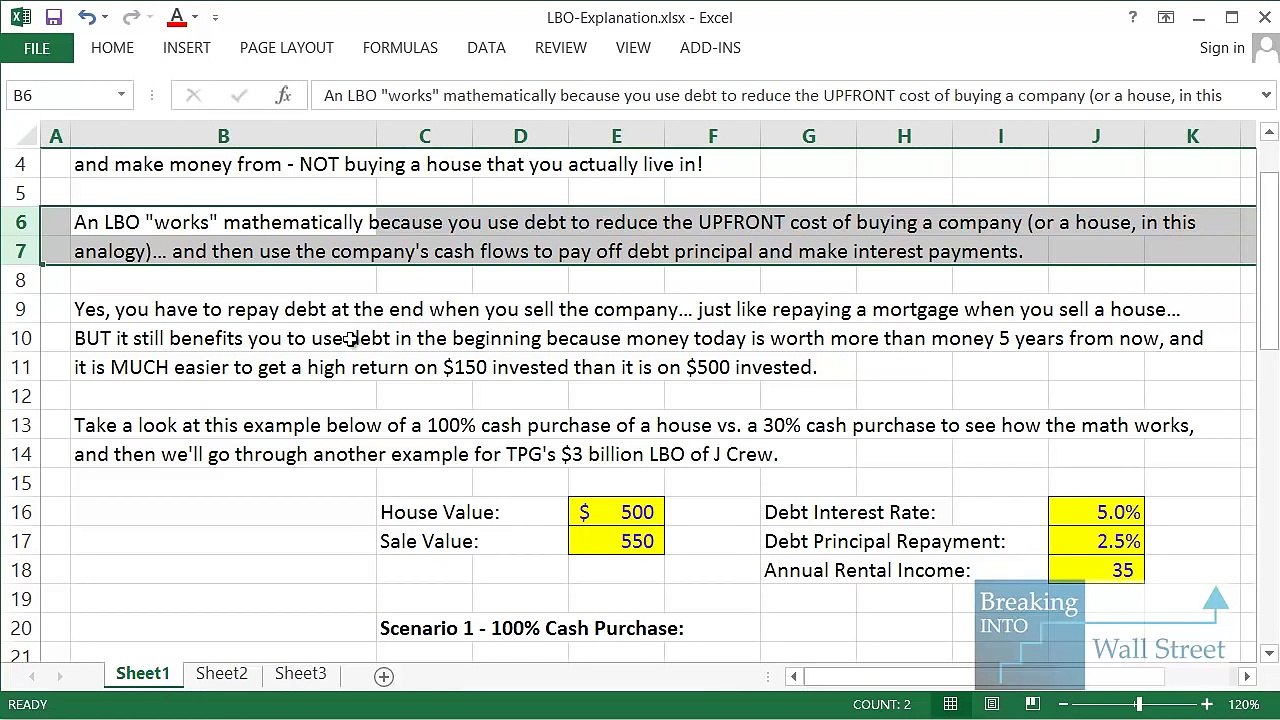

Learn the concept behind a leveraged buyout (LBO), and why and how an LBO Model works. <br />By http://breakingintowallstreet.com/ "Financial Modeling Training And Career Resources For Aspiring Investment Bankers" <br />The most common analogy used to explain an LBO is: "Buying a house with a cash down payment and a mortgage." <br /> <br />But that is a misleading way to think about it - because an LBO is more like buying a <br />house to rent out to *tenants* i.e. an asset that you earn cash flow from, as opposed <br />to a place to live in yourself. <br /> <br />An LBO "works" mathematically because leverage reduces the UPFRONT cost of buying a <br />company (or a house)... and then you use the company's cash flows to pay off debt principal <br />and interest rather than collecting them for yourself. <br /> <br />You still have to repay debt at the end when you sell the company... just like repaying <br />a mortgage when you sell a house... <br /> <br />BUT it still benefits you to use debt in the beginning because money today is worth more than money tomorrow, and because it's MUCH easier to get a high return on, say, $150 invested than it is on, say, $500 invested. <br /> <br /> <br /> <br /> <br />In this example with purchasing a house, we see how 100% cash used for a $500K house produces an IRR of 9% with a 1.5x returns multiple. <br /> <br />By contrast, when only 30% cash is used, the IRR increases to 15% and the returns multiple <br />increases to 1.9x. <br /> <br />Most private equity firms aim for IRRs of at least 20% (sometimes less than that in a weak market), so normally you can come close to or exceed 20% only by using leverage. <br /> <br />Exceptions apply for fast-growing companies and cases where the exit multiple or margins have expanded, but in general most PE firms rely on leverage to achieve IRRs in that range... <br /> <br />Well, assuming the company doesn't blow up and go bankrupt due to the high debt load - but that's another lesson for another day... <br /> <br />http://www.mergersandinquisitions.com/

Video Information

Views

40

Duration

13:16

Published

Jun 2, 2016

Related Trending Topics

LIVE TRENDSRelated trending topics. Click any trend to explore more videos.