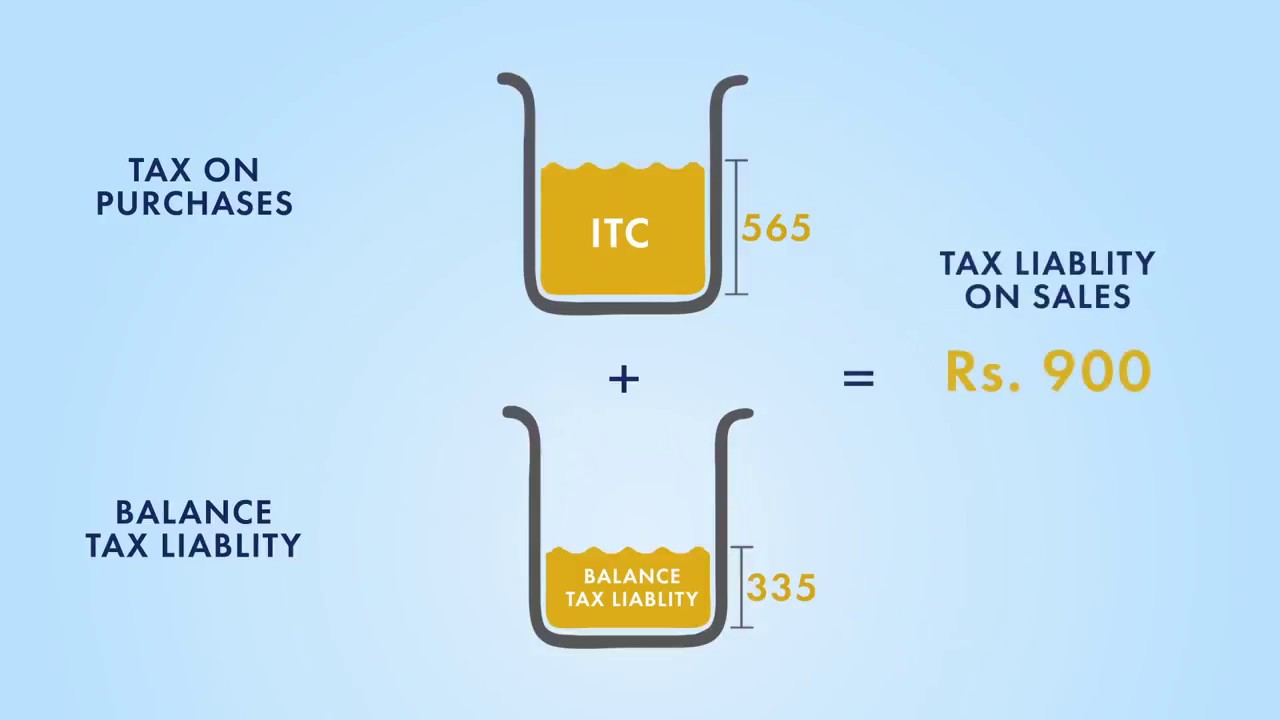

How GST Input Tax Credit Works in India

Learn how GST Input Tax Credit functions in India, including rules and examples for claiming credit under GST regulations. 💼

CA SATBIR SINGH

60.4K views • Aug 25, 2017

About this video

GST Input tax Credit

Input Tax Credit in GST ( India ) http://taxheal.com/input-tax-credit-gst-india-2.html

Example on Rule 5 of GST Input Tax Credit Rule – ITC on Capital Goods http://taxheal.com/example-rule-5-gst-input-tax-credit-rule-itc-capital-goods.html

Example on Rule 7 of GST Input Tax Credit Rule – Inputs Partly used for business and partly for other purposes http://taxheal.com/example-rule-7-gst-input-tax-credit-rule-inputs-partly-used-business-partly-purposes.html

Example Rule 8 of GST Input Tax Credit Rule – Capital Goods Partly used for Business and partly for other purposes http://taxheal.com/example-rule-8-gst-input-tax-credit-rule-capital-goods-partly-used-business-partly-purposes.html

Example Rule 9 GST Input Tax Credit Rules – Reversal of ITC on Inputs & Capital Goods http://taxheal.com/example-rule-9-gst-input-tax-credit-rules-reversal-itc-inputs-capital-goods.html

-~-~~-~~~-~~-~-

Please watch: "Income Tax News 03.10.2017 by TaxHeal"

https://www.youtube.com/watch?v=Yr98Lh4oXXg

-~-~~-~~~-~~-~-

Input Tax Credit in GST ( India ) http://taxheal.com/input-tax-credit-gst-india-2.html

Example on Rule 5 of GST Input Tax Credit Rule – ITC on Capital Goods http://taxheal.com/example-rule-5-gst-input-tax-credit-rule-itc-capital-goods.html

Example on Rule 7 of GST Input Tax Credit Rule – Inputs Partly used for business and partly for other purposes http://taxheal.com/example-rule-7-gst-input-tax-credit-rule-inputs-partly-used-business-partly-purposes.html

Example Rule 8 of GST Input Tax Credit Rule – Capital Goods Partly used for Business and partly for other purposes http://taxheal.com/example-rule-8-gst-input-tax-credit-rule-capital-goods-partly-used-business-partly-purposes.html

Example Rule 9 GST Input Tax Credit Rules – Reversal of ITC on Inputs & Capital Goods http://taxheal.com/example-rule-9-gst-input-tax-credit-rules-reversal-itc-inputs-capital-goods.html

-~-~~-~~~-~~-~-

Please watch: "Income Tax News 03.10.2017 by TaxHeal"

https://www.youtube.com/watch?v=Yr98Lh4oXXg

-~-~~-~~~-~~-~-

Tags and Topics

Browse our collection to discover more content in these categories.

Video Information

Views

60.4K

Likes

1.0K

Duration

1:36

Published

Aug 25, 2017

User Reviews

4.7

(12) Related Trending Topics

LIVE TRENDSRelated trending topics. Click any trend to explore more videos.