GST vs. SST: Key Differences You Need to Know 🧐

Learn the main differences between Goods and Service Tax (GST) and Sales and Service Tax (SST), and how they impact businesses and consumers. Get clarity on these important indirect taxes!

ROHIT kumar

89 views • Nov 29, 2016

About this video

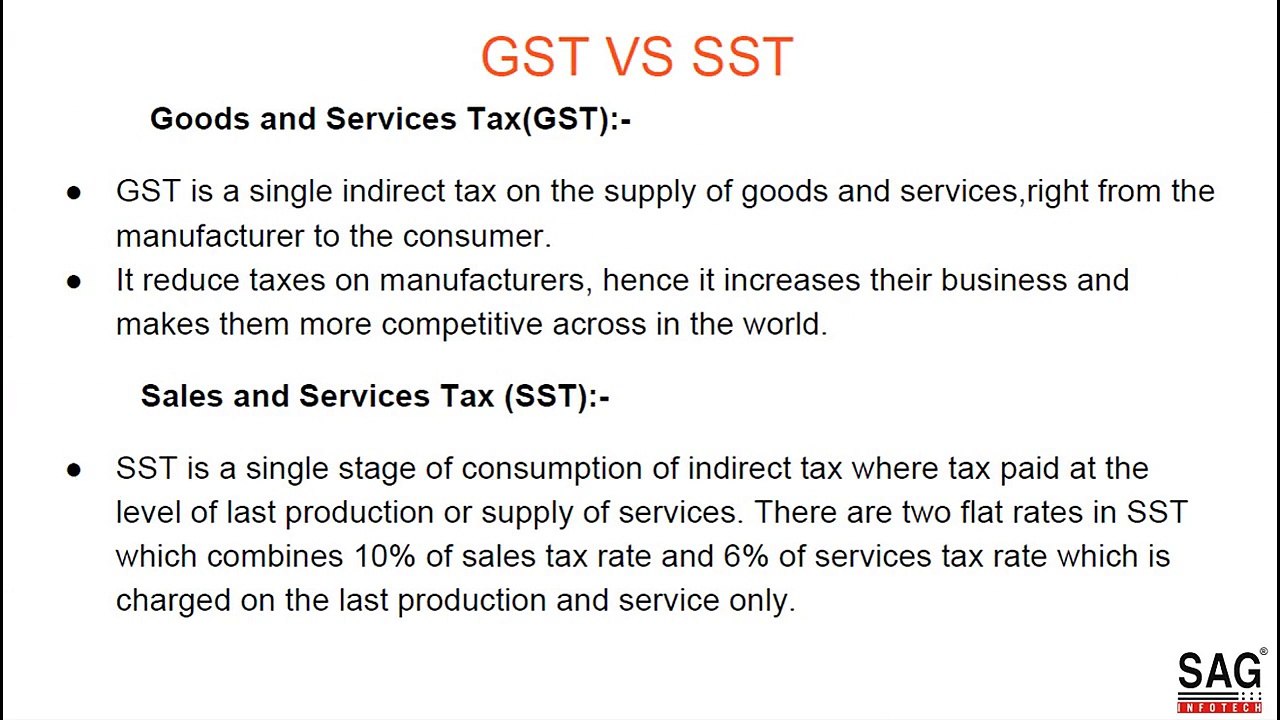

GST(Goods and Service Tax):- <br />GST is a single indirect tax on the supply of goods and services,right from the manufacturer to the consumer. <br /> <br />SST(Sales and Services Tax):- <br />SST is a single stage of consumption of indirect tax where tax paid at the level of last production or supply of services. There are two flat rates in SST which combines 10% of sales tax rate and 6% of services tax rate which is charged on the last production and service only. <br /> <br />We mention all important points related to GST VS SST. <br /> <br />Know More @ http://blog.saginfotech.com/difference-between-gst-and-sst-sales-service-tax

Video Information

Views

89

Duration

1:12

Published

Nov 29, 2016

Related Trending Topics

LIVE TRENDSRelated trending topics. Click any trend to explore more videos.

Trending Now