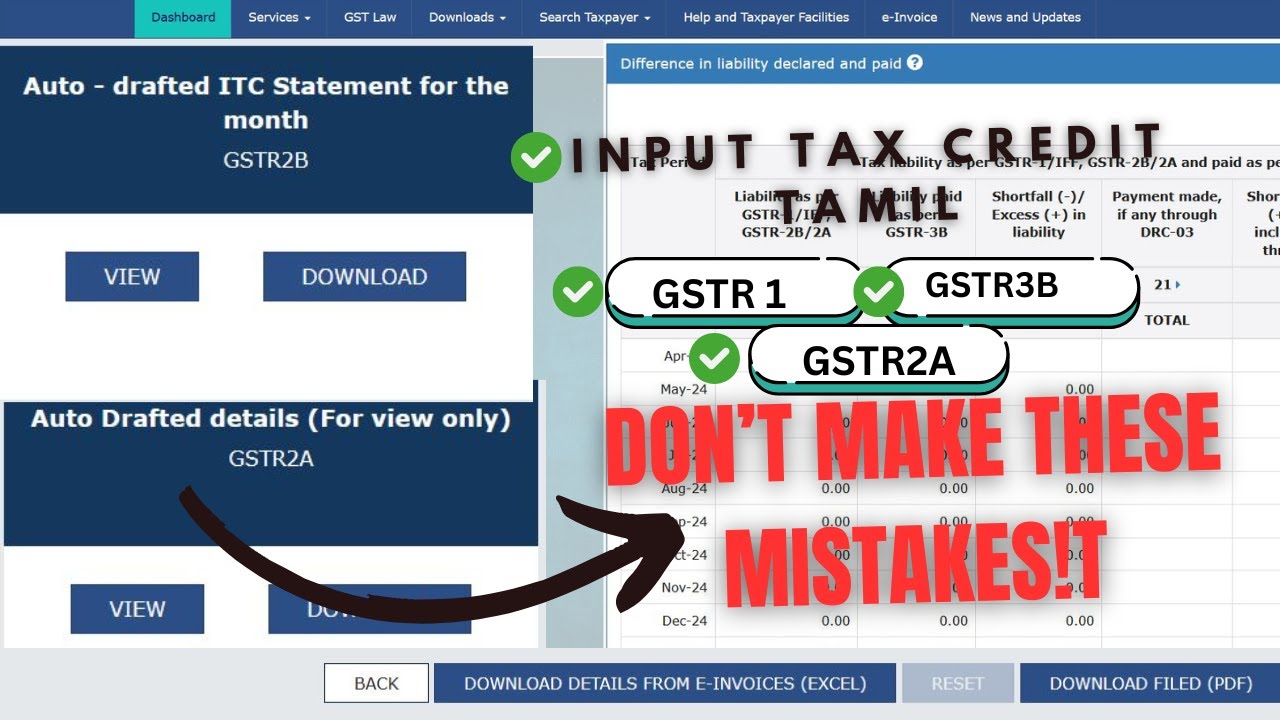

GST ITC Tamil: Complete Guide & Tips for 2025 📊

Learn about Input Tax Credit (ITC) under GST in Tamil, including common mistakes and expert tips for businesses, accountants, and students.

Rule Infinity

1.8K views • Jul 2, 2025

About this video

In this video we explain the concept of Input Tax Credit (ITC) under GST in Tamil. If you're a business owner, accountant, CA student, or GST practitioner, this is a must-watch!

👉 What is Input Tax Credit (ITC)?

Input Tax Credit is the GST you paid on your purchases, which you can adjust against your GST liability on sales. This helps reduce tax burden and avoid cascading taxes.

📌 In this 1-minute Tamil video, you will learn:

✅ What is ITC in GST?

✅ Basic conditions to claim ITC

✅ Common mistakes in availing ITC

✅ Important GST rules for ITC

✅ Real-life business scenario examples in Tamil

✅ How to avoid penalties and notices related to wrong ITC

📢 Key ITC Conditions (Simplified in Tamil):

Invoice must be in your name with GSTIN

Goods/services must be received

Supplier must have filed GSTR-1

ITC must reflect in your GSTR-2B

Payment must be made to the supplier within 180 days

ITC should not be blocked (e.g., personal expenses, car, etc.)

🚫 Common ITC Mistakes to Avoid:

❌ Claiming ITC without invoice

❌ Claiming ITC not in GSTR-2B

❌ Using wrong GSTIN

❌ ITC on ineligible items like food, beverages, motor vehicle

❌ Late ITC claim beyond the due date

GST ITC Tamil,Input Tax Credit in Tamil,GST Refund Tamil,GST Common Mistakes Tamil,ITC Rules 2025,GSTR 2B Reconciliation,Tally ITC,Input Tax Credit GST,Rule Infinity GST Course,GST Tamil Short Video,How to claim ITC Tamil,GST Training Tamil,GST Practical Course Tamil,GST for Business Owners,ITC eligibility GST Tamil,Blocked Credit Tamil,GST Filing Tips Tamil,GST Course Chennai,Tamil GST Filing

📚 Example:

A trader in Chennai bought office chairs with GST and used it for personal use – he cannot claim ITC. But if it’s for office staff, then ITC is valid.

🧾 Pro Tips for ITC Claim:

💡 Reconcile GSTR-2B every month

💡 Use accounting software like Tally, Zoho Books

💡 Cross-check with vendor filings

💡 File returns on time (GSTR-3B)

💡 Consult a CA if unsure

🌐 Who Can Benefit?

👨💼 Business Owners

👩🎓 Commerce Students

🧾 Accountants

🏢 Startups

🧑💻 Freelancers handling GST

🧑🏫 GST Trainers & Educators

📲 Subscribe to our channel “Rule Infinity Business Services” for more such tax tips, GST filing tutorials, and finance education in Tamil.

👍 Like | 🔔 Subscribe | 💬 Comment your doubts

📌 Check out our other playlists:

🎥 GST Tamil Tutorials

🎥 Income Tax for Individuals

🎥 Business Startup Compliance

🎥 Freelancing and Part-time GST Filing Jobs

📌 Follow us on Instagram & Facebook for updates on GST Courses and Free Webinars!

Follow Us

📸 Instagram rule_infinity_|

🎥 YouTube @RuleInfinitybusinessservices |

🌐 Website https://theruleinfinity.com/

📢 Disclaimer:

This video is only for educational purposes. Please consult a qualified tax professional before making any decisions.

👉 What is Input Tax Credit (ITC)?

Input Tax Credit is the GST you paid on your purchases, which you can adjust against your GST liability on sales. This helps reduce tax burden and avoid cascading taxes.

📌 In this 1-minute Tamil video, you will learn:

✅ What is ITC in GST?

✅ Basic conditions to claim ITC

✅ Common mistakes in availing ITC

✅ Important GST rules for ITC

✅ Real-life business scenario examples in Tamil

✅ How to avoid penalties and notices related to wrong ITC

📢 Key ITC Conditions (Simplified in Tamil):

Invoice must be in your name with GSTIN

Goods/services must be received

Supplier must have filed GSTR-1

ITC must reflect in your GSTR-2B

Payment must be made to the supplier within 180 days

ITC should not be blocked (e.g., personal expenses, car, etc.)

🚫 Common ITC Mistakes to Avoid:

❌ Claiming ITC without invoice

❌ Claiming ITC not in GSTR-2B

❌ Using wrong GSTIN

❌ ITC on ineligible items like food, beverages, motor vehicle

❌ Late ITC claim beyond the due date

GST ITC Tamil,Input Tax Credit in Tamil,GST Refund Tamil,GST Common Mistakes Tamil,ITC Rules 2025,GSTR 2B Reconciliation,Tally ITC,Input Tax Credit GST,Rule Infinity GST Course,GST Tamil Short Video,How to claim ITC Tamil,GST Training Tamil,GST Practical Course Tamil,GST for Business Owners,ITC eligibility GST Tamil,Blocked Credit Tamil,GST Filing Tips Tamil,GST Course Chennai,Tamil GST Filing

📚 Example:

A trader in Chennai bought office chairs with GST and used it for personal use – he cannot claim ITC. But if it’s for office staff, then ITC is valid.

🧾 Pro Tips for ITC Claim:

💡 Reconcile GSTR-2B every month

💡 Use accounting software like Tally, Zoho Books

💡 Cross-check with vendor filings

💡 File returns on time (GSTR-3B)

💡 Consult a CA if unsure

🌐 Who Can Benefit?

👨💼 Business Owners

👩🎓 Commerce Students

🧾 Accountants

🏢 Startups

🧑💻 Freelancers handling GST

🧑🏫 GST Trainers & Educators

📲 Subscribe to our channel “Rule Infinity Business Services” for more such tax tips, GST filing tutorials, and finance education in Tamil.

👍 Like | 🔔 Subscribe | 💬 Comment your doubts

📌 Check out our other playlists:

🎥 GST Tamil Tutorials

🎥 Income Tax for Individuals

🎥 Business Startup Compliance

🎥 Freelancing and Part-time GST Filing Jobs

📌 Follow us on Instagram & Facebook for updates on GST Courses and Free Webinars!

Follow Us

📸 Instagram rule_infinity_|

🎥 YouTube @RuleInfinitybusinessservices |

🌐 Website https://theruleinfinity.com/

📢 Disclaimer:

This video is only for educational purposes. Please consult a qualified tax professional before making any decisions.

Tags and Topics

Browse our collection to discover more content in these categories.

Video Information

Views

1.8K

Duration

14:49

Published

Jul 2, 2025

User Reviews

3.7

(1) Related Trending Topics

LIVE TRENDSRelated trending topics. Click any trend to explore more videos.

Trending Now