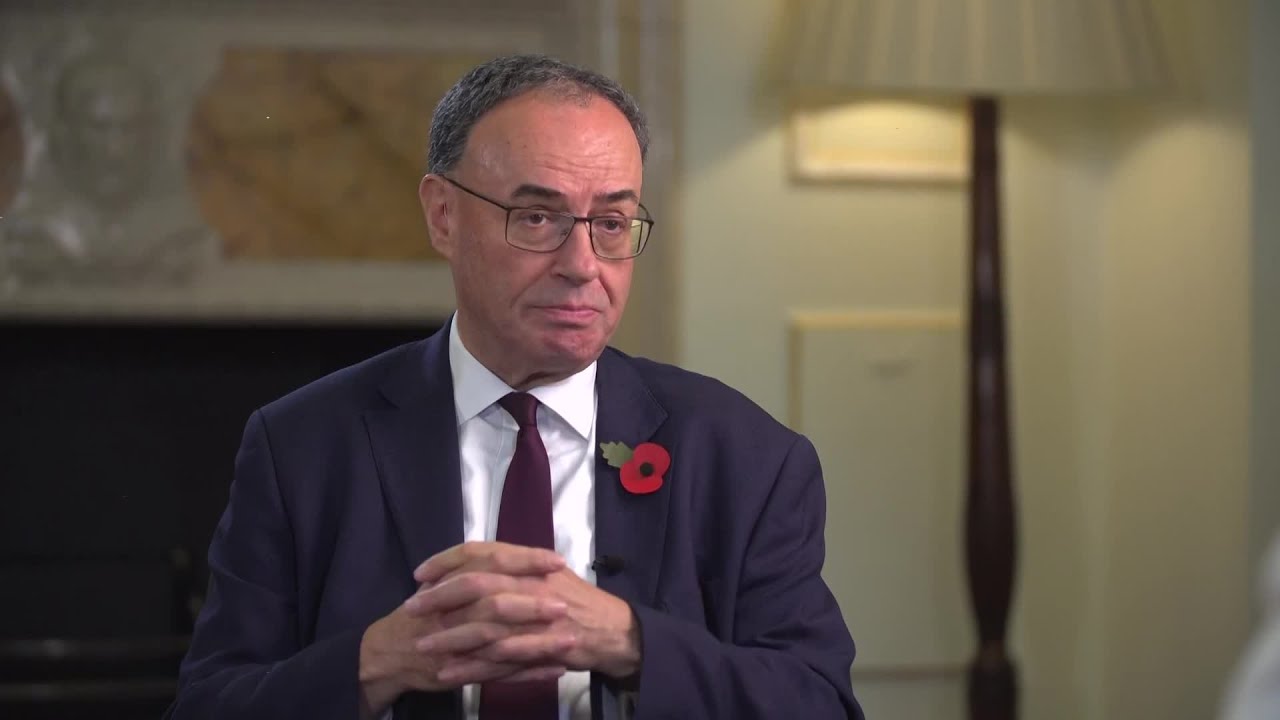

Bailey to Complete Bank of England Term 🏦

Bank of England keeps interest rates at 4%, with a December rate cut expected. Bailey commits to serving his full term amid a close vote.

Bloomberg Podcasts

2.2K views • Nov 6, 2025

About this video

The Bank of England held interest rates at 4% in a tight vote that laid the groundwork for a December cut.

Five members of the Monetary Policy Committee voted to leave policy unchanged, with Governor Andrew Bailey swinging the decision, while four called for a quarter-point cut to 3.75%. The BOE said September inflation of 3.8% was “likely to be the peak.”

The meeting’s minutes showed Bailey was the most dovish of the officials who held rates. The governor edged closer to backing a reduction, judging that the risks to inflation had “moved down to become more balanced recently.”

“We still think rates are on a gradual path downwards, but we need to be sure that inflation is on track to return to our 2% target before we cut them again,” he said in a written statement.

The decision marked a break from the quarterly pace of easing the BOE has maintained since August 2024. However, the BOE also set the scene for a move in December, by which time the committee will have seen the Labour government’s crucial autumn budget later this month and two more rounds of inflation and jobs data.

While the decision was anticipated by markets, the BOE altered its guidance to state that rates are “likely to continue on a gradual downward path.” The word “careful” was dropped from the language on future cuts.

Kallum Pickering, chief economist at Peel Hunt, said the decision was a “dovish hold.”

“This sets the BoE up for a cut in December as long as inflation continues to decline and the government does not announce any inflationary tax or spending measures,” he said.

The pound weakened against the euro after the decision, reversing earlier gains, as traders increased bets on monetary easing in the coming months. They are pricing about 51 basis points of interest-rate cuts by the middle of 2026 compared with 47 basis points before the decision. That boosted gilts, with the yield on two-year notes down three basis points at 3.77%.

‘Lively debate’

In a news conference following the decision, Bailey appeared to endorse market pricing pointing to bank rate settling at around 3.5%, though cautioned that it’s still uncertain where borrowing costs end up. Deputy Governor Clare Lombardelli said there’s “a very lively debate” on the MPC about the neutral rate.

“With every cut in bank rate, how much further to go becomes a closer call,” Bailey said. “For me, the market curve at the moment does give a reasonable view, I think, of a sensible path. By the way, that’s not always the case.”

While Bailey refused to be drawn into speculation ahead of the budget, he said the government has acknowledged the impact of regulated prices on inflation. Following the decision, Chancellor of the Exchequer Rachel Reeves said her budget will help to “cut the cost of living” as she highlighted the BOE’s forecast for weaker inflation in the near term.

Individual MPC members were able to explain the rationale behind their decisions in an overhaul of the bank’s communications. Bailey said that “upside risks to inflation have become less pressing since August,” and opted to hold in order to wait for more evidence.

He added that his position reflected a “forward looking Taylor rule” path for rates that the bank’s documents showed implied three more rate cuts over the coming year. Voting alongside Bailey were Lombardelli, Chief Economist Huw Pill and external members Catherine Mann and Megan Greene.

For the first time since joining the committee in 2023 Deputy Governor for Financial Stability Sarah Breeden split from Bailey, preferring to cut rates. She said “upside risks to inflation have diminished” while downside risks to demand “have become more prominent.”

Deputy Governor for Markets Dave Ramsden and external members Alan Taylor and Swati Dhingra were the other doves.

Bloomberg Economics’ BOESPEAK index, an automated model that tracks the interest-rate sentiment within MPC comments, moved slightly in a more dovish direction after the release and media conference, continuing a shift toward rate cut expectations over the last two weeks.

--------

Watch Bloomberg Radio LIVE on YouTube

Weekdays 7am-6pm ET

WATCH HERE: http://bit.ly/3vTiACF

Follow us on X: https://twitter.com/BloombergRadio

Subscribe to our Podcasts:

Bloomberg Daybreak: http://bit.ly/3DWYoAN

Bloomberg Surveillance: http://bit.ly/3OPtReI

Bloomberg Intelligence: http://bit.ly/3YrBfOi

Balance of Power: http://bit.ly/3OO8eLC

Bloomberg Businessweek: http://bit.ly/3IPl60i

Listen on Apple CarPlay and Android Auto with the Bloomberg Business app:

Apple CarPlay: https://apple.co/486mghI

Android Auto: https://bit.ly/49benZy

Visit our YouTube channels:

Bloomberg Podcasts: https://www.youtube.com/bloombergpodcasts

Bloomberg Television: https://www.youtube.com/@markets

Bloomberg Originals: https://www.youtube.com/bloomberg

Quicktake: https://www.youtube.com/@BloombergQuicktake

Five members of the Monetary Policy Committee voted to leave policy unchanged, with Governor Andrew Bailey swinging the decision, while four called for a quarter-point cut to 3.75%. The BOE said September inflation of 3.8% was “likely to be the peak.”

The meeting’s minutes showed Bailey was the most dovish of the officials who held rates. The governor edged closer to backing a reduction, judging that the risks to inflation had “moved down to become more balanced recently.”

“We still think rates are on a gradual path downwards, but we need to be sure that inflation is on track to return to our 2% target before we cut them again,” he said in a written statement.

The decision marked a break from the quarterly pace of easing the BOE has maintained since August 2024. However, the BOE also set the scene for a move in December, by which time the committee will have seen the Labour government’s crucial autumn budget later this month and two more rounds of inflation and jobs data.

While the decision was anticipated by markets, the BOE altered its guidance to state that rates are “likely to continue on a gradual downward path.” The word “careful” was dropped from the language on future cuts.

Kallum Pickering, chief economist at Peel Hunt, said the decision was a “dovish hold.”

“This sets the BoE up for a cut in December as long as inflation continues to decline and the government does not announce any inflationary tax or spending measures,” he said.

The pound weakened against the euro after the decision, reversing earlier gains, as traders increased bets on monetary easing in the coming months. They are pricing about 51 basis points of interest-rate cuts by the middle of 2026 compared with 47 basis points before the decision. That boosted gilts, with the yield on two-year notes down three basis points at 3.77%.

‘Lively debate’

In a news conference following the decision, Bailey appeared to endorse market pricing pointing to bank rate settling at around 3.5%, though cautioned that it’s still uncertain where borrowing costs end up. Deputy Governor Clare Lombardelli said there’s “a very lively debate” on the MPC about the neutral rate.

“With every cut in bank rate, how much further to go becomes a closer call,” Bailey said. “For me, the market curve at the moment does give a reasonable view, I think, of a sensible path. By the way, that’s not always the case.”

While Bailey refused to be drawn into speculation ahead of the budget, he said the government has acknowledged the impact of regulated prices on inflation. Following the decision, Chancellor of the Exchequer Rachel Reeves said her budget will help to “cut the cost of living” as she highlighted the BOE’s forecast for weaker inflation in the near term.

Individual MPC members were able to explain the rationale behind their decisions in an overhaul of the bank’s communications. Bailey said that “upside risks to inflation have become less pressing since August,” and opted to hold in order to wait for more evidence.

He added that his position reflected a “forward looking Taylor rule” path for rates that the bank’s documents showed implied three more rate cuts over the coming year. Voting alongside Bailey were Lombardelli, Chief Economist Huw Pill and external members Catherine Mann and Megan Greene.

For the first time since joining the committee in 2023 Deputy Governor for Financial Stability Sarah Breeden split from Bailey, preferring to cut rates. She said “upside risks to inflation have diminished” while downside risks to demand “have become more prominent.”

Deputy Governor for Markets Dave Ramsden and external members Alan Taylor and Swati Dhingra were the other doves.

Bloomberg Economics’ BOESPEAK index, an automated model that tracks the interest-rate sentiment within MPC comments, moved slightly in a more dovish direction after the release and media conference, continuing a shift toward rate cut expectations over the last two weeks.

--------

Watch Bloomberg Radio LIVE on YouTube

Weekdays 7am-6pm ET

WATCH HERE: http://bit.ly/3vTiACF

Follow us on X: https://twitter.com/BloombergRadio

Subscribe to our Podcasts:

Bloomberg Daybreak: http://bit.ly/3DWYoAN

Bloomberg Surveillance: http://bit.ly/3OPtReI

Bloomberg Intelligence: http://bit.ly/3YrBfOi

Balance of Power: http://bit.ly/3OO8eLC

Bloomberg Businessweek: http://bit.ly/3IPl60i

Listen on Apple CarPlay and Android Auto with the Bloomberg Business app:

Apple CarPlay: https://apple.co/486mghI

Android Auto: https://bit.ly/49benZy

Visit our YouTube channels:

Bloomberg Podcasts: https://www.youtube.com/bloombergpodcasts

Bloomberg Television: https://www.youtube.com/@markets

Bloomberg Originals: https://www.youtube.com/bloomberg

Quicktake: https://www.youtube.com/@BloombergQuicktake

Video Information

Views

2.2K

Likes

6

Duration

8:28

Published

Nov 6, 2025

User Reviews

3.9

(2) Related Trending Topics

LIVE TRENDSRelated trending topics. Click any trend to explore more videos.

Trending Now